Example of Alerts during COVID

When unknown unknowns hit your quantitative strategies, our adaptive risk signals shift quickly

Cracks Emerge

In January 2020, a sideways market and COVID-related volatility signaled a stall in the previous bullish SPY trend.

Risk Off

Getting a day or two head start was a significant advantage when markets turned quickly. Extremely elevated vol forecasts helped weather the choppy markets.

Risk On

Picking the bottom is very hard, but by using Breakpoint to trade-off between the signal and the noise we have higher confidence entry signals.

All of this powered by 1000's of models competing to explain market moves and the 'magic' of robust bayesian statistics.View the full video here or See Use Cases

How to use Breakpoint

A focus on actionable insights to improve your investment process

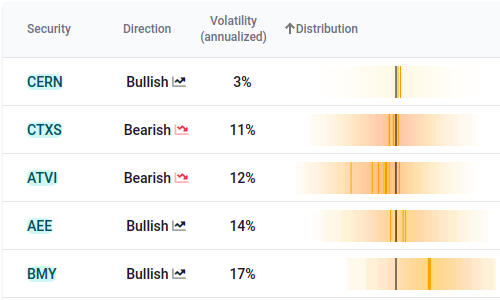

Option Trading Signals

Go from Risk Alert to Optimized Option trades quickly.Match the shape of the forecast to the correct Bullish / Bearish / Neutral option structure. Here are some short vol, bullish and bearish signals.

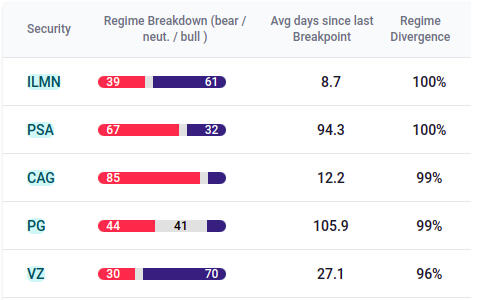

Watch for Cracks

Monitor all your quant signals for emerging regimes to better catch shifts in performance.Here we see securities with high model divergence; a useful sign that there are conflicting signals in the trends of a given stock.

Improve Trade Timing

Use Breakpoint signals to better time entry and exit points.Put a robust process behind your take-profit levels.Here we see stocks with high relative forecast volatility and recent Breakpoints.

Integrations

Bring these signals into your own workflow

Volos Portfolio Solutions

Build innovative indexes using systematic options strategies and our Breakpoint Risk Signals

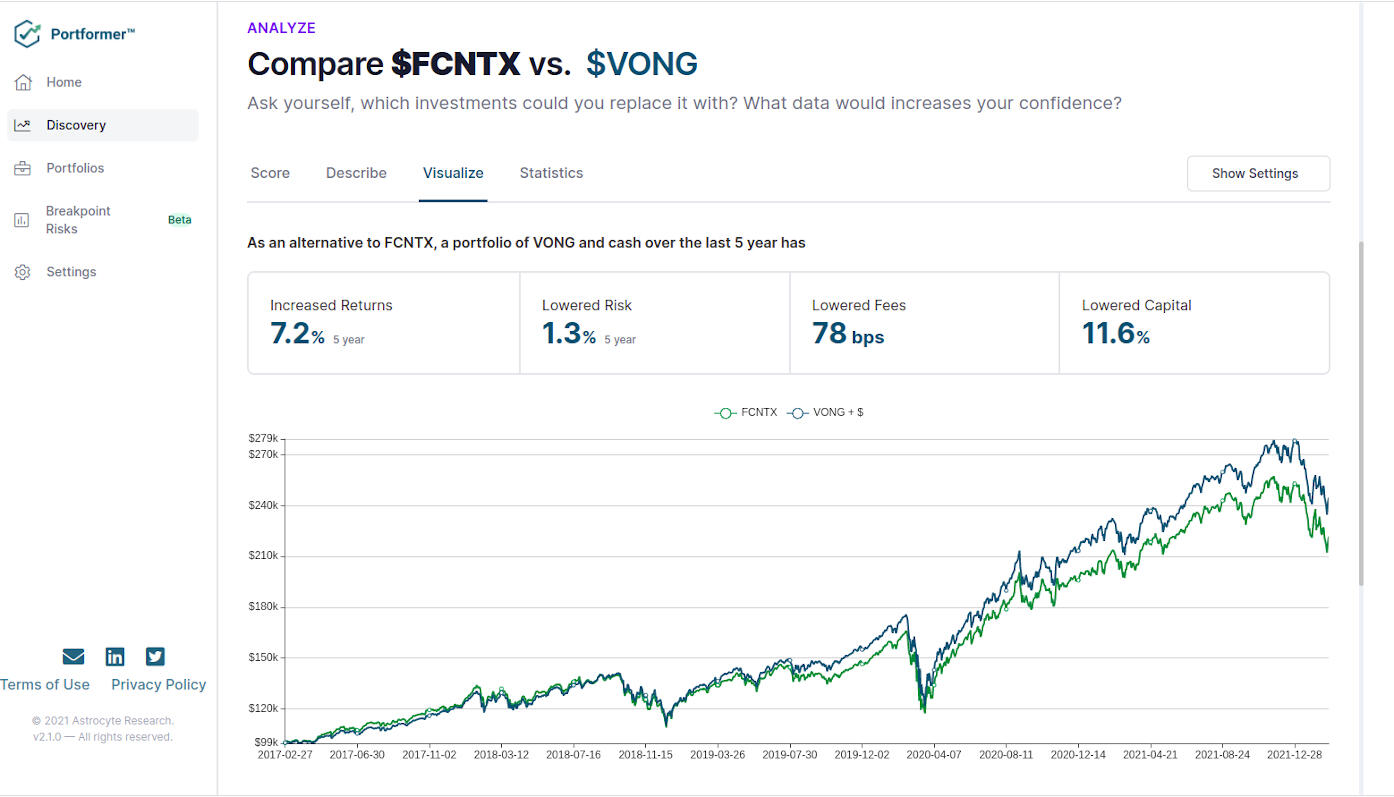

Portformer

Portfolios, made better, by instantly identifying higher quality, lower cost ETFs for you and your clients.

Go deeper

We have more tools, technology and in-house expertise to help solve many of your investment challenges

© Astrocyte Research 2022. All rights reserved.